owner draw vs retained earnings

Answer 1 of 8. Dividends are paid out of the profits and reserves of a company.

Accumulated Other Comprehensive Income And Treasury Stock Accountingcoach

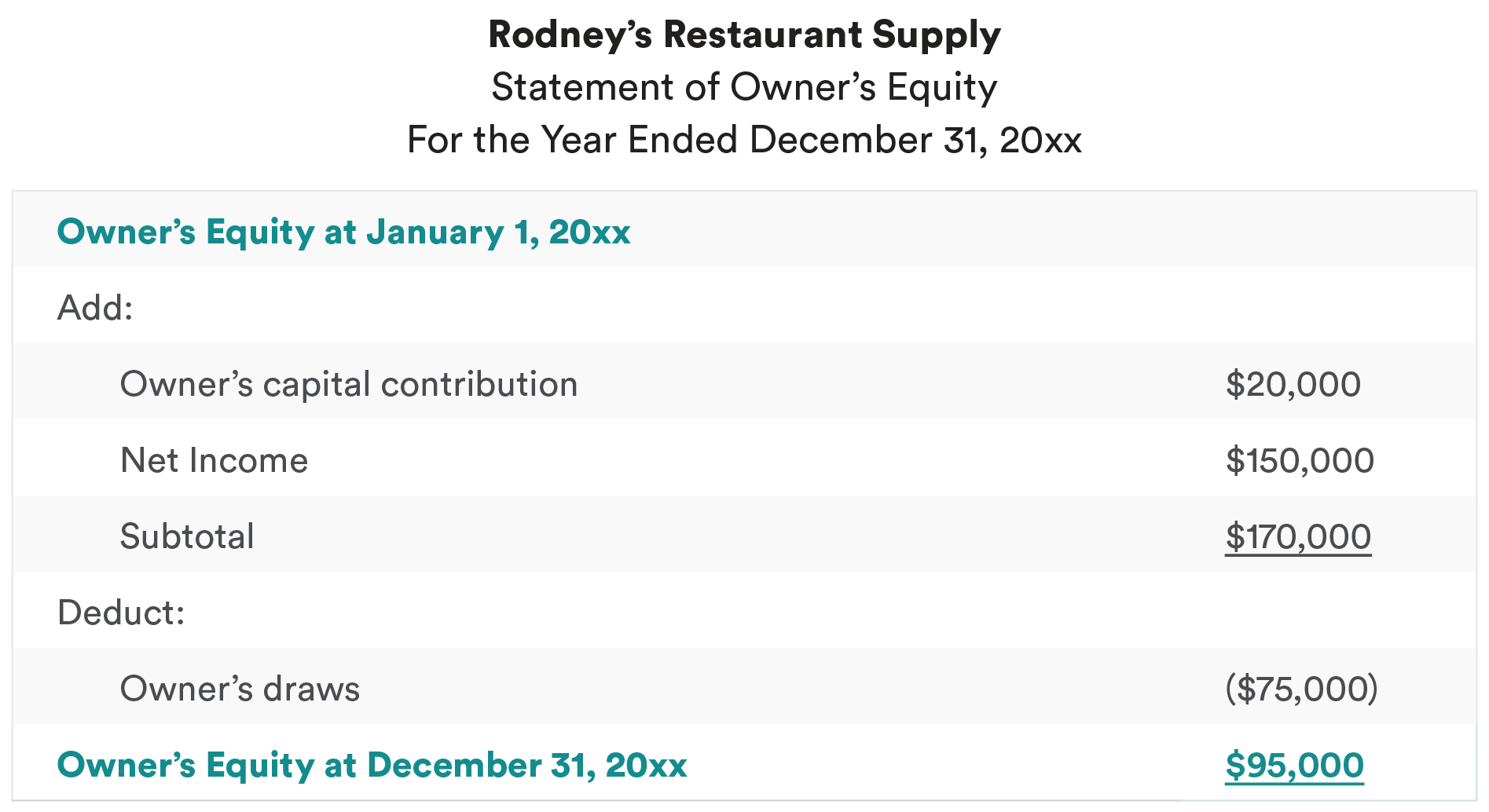

Owners Equity 400 Assets 1200 Liabilities 800.

. Owners Contributions is the account similar to common stock used to represent a direct investment by the owner not accumulated earnings. There are two journal entries for Owners Drawing account. At the time of the distribution of funds to an owner debit the Owners Drawing account and credit the Cash in Bank account.

A typical sole proprietorship keeps two separate accounts for this equity. Normally this happens in a single. The WHY you took funds draw.

The one that does NOT have a Register view no matter. The business would record. Statement of equity and.

It creates a negative drawings impact on the business. Owners equity vs retained earnings. Personal funds the owner used to start up and operate the business and.

To calculate the retained. To figure retained earnings as of January 1 2014 you add or subtract the amount of income the company made or lost during to the 45000 prior balance in. As for Owner Equity open the chart of accounts and try to open each Equity account.

An owners draw also known as a draw is when the business owner takes money out of the business for personal use. 4000 in net income at the end of the period. Owners Drawings are any withdrawals by the owners from the business either in the form of goods services or cash for their personal use.

It means owners can draw out of profits or retained earnings of a business. Beginning RE of 5000 when the reporting period started. Often directors and owners draw more funds than accumulated retained earnings hence the equity.

Beginning RE of 5000 when the reporting period started. Owners Capital and Owners Draw. 2000 in dividends paid out during the period.

The draw decreases the owners capital record and owners equity so now the equation will be. How do you close out owners draw to Retained Earnings. Owners draws can be scheduled at regular intervals or taken only.

An owners draw is an amount of money an owner takes out of a business usually by writing a check. Say for example that Patty has accumulated a 120000 owner equity balance in Riverside Catering.

How Do Businesses Use Retained Earnings And How Can Accountants Help Sage Advice Us

Accounting Knowledge Poster Wall Decor Best Gift For Your Friend And R In 2022 Knowledge Accounting Basics Learn Accounting

Retained Earnings The Link Between Balance Sheet And Income Statement Crash Course In Accounting And Financial Statement Analysis Second Edition Book

What Happens With Retained Earnings When You Sell Your Company

What Are Retained Earnings Guide Formula And Examples

What Are Retained Earnings Guide Formula And Examples

What Are Retained Earnings Bdc Ca

Is Retained Earnings An Asset Hourly Inc

Financial Accounting Bba Bba Bi Bba Tt 2nd Sem Question Paper 2020 Financial Accounting Question Paper Financial

Retained Earnings Explained 5 Mins Youtube

Debit And Credit Chart Accounting And Finance Accounting Accounting Career

What Are Retained Earnings Guide Formula And Examples

:max_bytes(150000):strip_icc()/BOA-f8957c5ee9c14788b59a7e5edd802a7b.jpg)

Which Transactions Affect Retained Earnings

Owner S Equity What It Is And How To Calculate It Bench Accounting