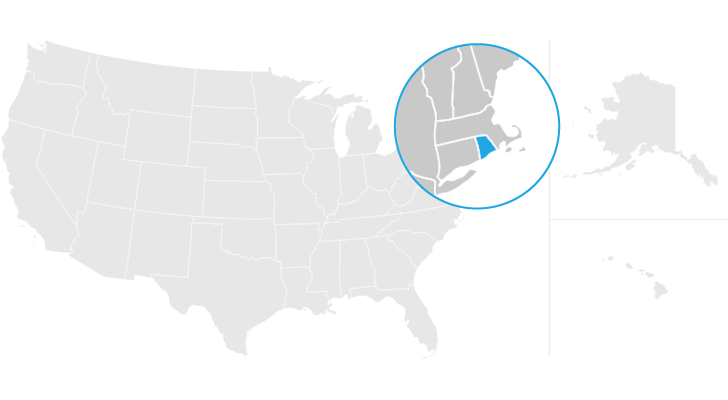

rhode island property tax rates 2020

Only the Federal Income Tax applies. The Effective Tax Rate is used to compare.

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

2021 New Jersey Property Tax Rates and 2020 Average Tax Bills.

. Detailed South Dakota state income tax rates and brackets are available on this page. Texas has no state income tax. Click here for a map with more tax rates.

The general tax rate is used to compute the tax on a property. The General Tax Rate is used to calculate the tax assessed on a property. Texas has never had a personal income tax and restrictions in.

However revenue lost to Texas by not having a personal income tax may be made up through other state-level taxes such as the Texas sales tax and the Texas property tax. The South Dakota income tax has one tax bracket with a maximum marginal income tax of 000 as of 2022. Updated February 18 2022.

It is equal to 10 per 1000 of taxable assessed value. Texas is one of seven states that do not collect a personal income tax.

Property Taxes How Much Are They In Different States Across The Us

Rhode Island Property Tax Calculator Smartasset

Rhode Island Retirement Taxes And Economic Factors To Consider

Climate Change In Rhode Island Wikipedia

Rhode Island Sales Tax Guide And Calculator 2022 Taxjar

Rhode Island Estate Tax Everything You Need To Know Smartasset